So, the "Momentum" players have apparently said "Yes" to a continuation of the recent equity rally and whats probably more significant on Friday........to a potential reversal down in Fixed Interest. But are they correct?

As watchers of this Blog may be already aware, I assign no fundamental economic interpretation to any price movements. I am solely concerned with the Rate of change of prices over various diversified time horizons and what I can predict from statistically analysed results of my Trading models.

We all know, however, that "Momentum" analysis on its own is a lagging indicator and typically on longer term charts often signal at the latter stage of a rally especially following a reversal of a previously persistent trend.

Over the years, I have found it VERY helpful to overlay a particular favourite contrarian indicator of mine namely "Divergence" whether it be up or down.

For the un-initiated, this indicator can identify potential Bull or Bear traps shown when Higher/Lower prices are no longer accompanied with Increasing/Decreasing Momentum.

Of course, Divergence in the Short term can be the catalyst for invaluable market Mean Reversions and an opportunity to re-establish "longs" or "shorts" in the same directiion of the main trend at more advantageous average prices. For example, the DAX could fall 200 pts and yet the Medium momentum trend would still be "UP". So the importance is to attach "Risk" to any particular price by keeping in touch, not just whether momentum is positive or negative, but more imortantly have a measure of the "rate of change" of momentum and predict whether it will continue.

Outlined below, is the latest snapshot of a range of Exchange Traded derivative across the front month contracts in Fixed Interest, Equities. Forex and some Commodities. This of course is only a snapshot and in the real world my models are "adaptive" to real time prices. For an explanation of how these numbers are calculated please refer to earlier posts

Enjoy

Legend

Red - Price statistically Overbought and should experience some Reversion to Mean

Blue - Price statistically Oversold and should experience som Reversion to Mean

Black- Last Price at Posting

Yellow - Central Daily Moving Average Pivot. Close above indicate recent strength. Close below indicates recent weakness

Daily Trend- Positive / Negative / Neutral

St Dev - Rate of change of Daily Trend momentum (Accelerating Up/ Down/ Contracting)

Saturday, 16 October 2010

Global Macro CTA - Standard Deviation Price Tables

Wednesday, 6 October 2010

FOREX- Protecting Long EurUSD Profits NOW

All

As you know in Systematic Trading I firmly believe it is not my business to pick tops or bottoms.

Trend following models in any form, however, aspire to remain in the same trade for the longest amount of time as long as the trend is persistent. However we can readily accept that few trends are linear straight line affairs and diversification over timescales/time horizons provides a broader objective assessment of maximising P&L'

The EURUSD is circa 20 big figs higher that the recent 1.1890 June 6TH or so low in Q2 2010. The trend obseved by many Momentum followers remains "Up" and for Greenback weakness to continue to continue......or will it????

It is however always prudent to money manage any position. Not by undermining the original hypothesis for the long but at key pre determined objectives to be patient and accept that the rate of change of the trend may be changing.

Hence with current Spot at 1.3850 I suggest that to protect EURUSD long entry 1.2300, I am now prepared to write 1.4000 DEC CALL Receiving 2.36 effectivly allowing me to partial exit 1.4236

The trend in the underlying may continue higher but I can assess the rate of change of momentum at a later stage and either decide whether to remain in the trend

Enjoy

As you know in Systematic Trading I firmly believe it is not my business to pick tops or bottoms.

Trend following models in any form, however, aspire to remain in the same trade for the longest amount of time as long as the trend is persistent. However we can readily accept that few trends are linear straight line affairs and diversification over timescales/time horizons provides a broader objective assessment of maximising P&L'

The EURUSD is circa 20 big figs higher that the recent 1.1890 June 6TH or so low in Q2 2010. The trend obseved by many Momentum followers remains "Up" and for Greenback weakness to continue to continue......or will it????

It is however always prudent to money manage any position. Not by undermining the original hypothesis for the long but at key pre determined objectives to be patient and accept that the rate of change of the trend may be changing.

Hence with current Spot at 1.3850 I suggest that to protect EURUSD long entry 1.2300, I am now prepared to write 1.4000 DEC CALL Receiving 2.36 effectivly allowing me to partial exit 1.4236

The trend in the underlying may continue higher but I can assess the rate of change of momentum at a later stage and either decide whether to remain in the trend

Enjoy

Thursday, 30 September 2010

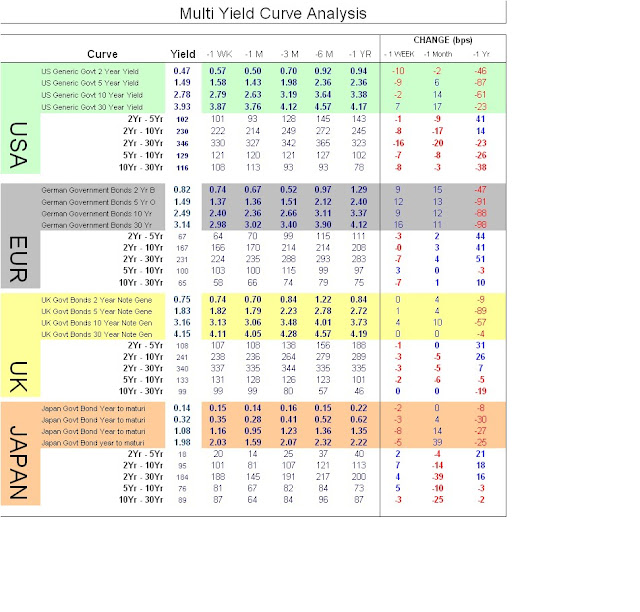

Multi Yield Curve Analysis-Update

Ahead of important US GDp numbers today, I thought it would be useful to give an update of the four main Govenmrnt Bond Yield Curves that I look at, USA, Eur, Jpy and UK.

This is an unemotional statistical summary and I do not claim to attribute any "fundamenatal economic" justifacation for the shape or recent changes in the shape of various segments of each Curve.

Enjoy.

This is an unemotional statistical summary and I do not claim to attribute any "fundamenatal economic" justifacation for the shape or recent changes in the shape of various segments of each Curve.

Enjoy.

Sunday, 26 September 2010

Global Macro Futures- Standard Deviation Price Tables

Outlined below is the latest Table of Stand deviation price Tables for 8 Euity Exchange traded derivatives and 9 Fixed Interest as at Close of trading on Friday last

For a more detailed explanation of how these values are derived please refer to earlier Post 10 Sept 2010.

Legend

Red - Price statistically Overbought and should experience some Reversion to Mean

Blue - Price statistically Oversold and should experience som Reversion to Mean

Black- Last Price at Posting

Yellow - Central Daily Moving Average Pivot. Close above indicate recent strength. Close below indicates recent weakness

Daily Trend- Positive / Negative / Neutral

St Dev - Rate of change of Daily Trend momentum (Accelerating Up/ Down/ Contracting)

For a more detailed explanation of how these values are derived please refer to earlier Post 10 Sept 2010.

Legend

Red - Price statistically Overbought and should experience some Reversion to Mean

Blue - Price statistically Oversold and should experience som Reversion to Mean

Black- Last Price at Posting

Yellow - Central Daily Moving Average Pivot. Close above indicate recent strength. Close below indicates recent weakness

Daily Trend- Positive / Negative / Neutral

St Dev - Rate of change of Daily Trend momentum (Accelerating Up/ Down/ Contracting)

Eur & Usa Yield Curve Segment Analysis-Week 40

Every week, I post a snapshot of the USA and EUR Govenment Bond Yield Curves and overlay one of my Trending strategies on various Segments of each Curve.

As mentioned in many of my Blogs, I look at these Systematically, without offering any "fundamental" or "economic" reasoning for these changes

The trending indicators are represented over 2 Trading Time horizons

As mentioned in many of my Blogs, I look at these Systematically, without offering any "fundamental" or "economic" reasoning for these changes

The trending indicators are represented over 2 Trading Time horizons

- Weekly- Longer Term Investment play

- Daily- Shorter Term Trading

|

| [click to enlarge] |

Wednesday, 22 September 2010

Global Macro Futures - Standard Deviation Price Tables Update

I have learned over the years to view with a degree of cynicism the blanket "blind" acceptance of many forms of Technical Analysis or Charting, particularly the unproven, un-tested, non validated claims of many of its proponents.

Sure, we all need tools or crutches to trigger or support our investment decisions but it has taken me a long time to distinguish the "Voodoo Analysis" from the scientific, statistically validated approach I now try to implement.

You will see many reference in my Blog to various forms of Standard Deviation. Notably in the case of Momentum studies I am more keen to understand the "Rate of change of Momentum"as the direction of the Momentum itself . In many circumstances we can learn so much more from the second derivative.

Oulined below is the latest Table of Standard Deviation of PriceVolatilty derived from four central Moving Averages (Weekly, Daily,30 mins and 5 mins). For a more detailed explanation of how these numbers are derived and what periods and type of MA used please see earlier Post 10 Sept.

These Tables may or may not turn out to be "Supprt or Resistance" levels but they are a statistically consistent generation tabular form where the Mean Reversion have been evidenced and validated.

Enjoy.

Red- statistically Prices Overbought and should experience some Reversion to Mean

Black-last price at time of Post

Yellow-Daily Pivot, the Central moving average. Price above indicate recent strength. Prices below indicate recent weakness

Blue- statistically prices Oversold and should experience some Reversion to Mean

Daily Trend- Positive / Negative / Neutral

StDev-Rate of change of Daily Momentum: Accelerating Up/ Down / Contracting

Sure, we all need tools or crutches to trigger or support our investment decisions but it has taken me a long time to distinguish the "Voodoo Analysis" from the scientific, statistically validated approach I now try to implement.

You will see many reference in my Blog to various forms of Standard Deviation. Notably in the case of Momentum studies I am more keen to understand the "Rate of change of Momentum"as the direction of the Momentum itself . In many circumstances we can learn so much more from the second derivative.

Oulined below is the latest Table of Standard Deviation of PriceVolatilty derived from four central Moving Averages (Weekly, Daily,30 mins and 5 mins). For a more detailed explanation of how these numbers are derived and what periods and type of MA used please see earlier Post 10 Sept.

These Tables may or may not turn out to be "Supprt or Resistance" levels but they are a statistically consistent generation tabular form where the Mean Reversion have been evidenced and validated.

Enjoy.

Red- statistically Prices Overbought and should experience some Reversion to Mean

Black-last price at time of Post

Yellow-Daily Pivot, the Central moving average. Price above indicate recent strength. Prices below indicate recent weakness

Blue- statistically prices Oversold and should experience some Reversion to Mean

Daily Trend- Positive / Negative / Neutral

StDev-Rate of change of Daily Momentum: Accelerating Up/ Down / Contracting

Monday, 20 September 2010

Multi Yield Curve Analysis- Part 2

Yesterday, I posted a review of the EUR, USA, JPY and UK Government Bond Yield Curves showing the absolute current values of certain segments of these curves.

I have overlaid one of my Trend following strategies on the EUR and USA Curves with the following results:

|

| [Click to Enlarge] |

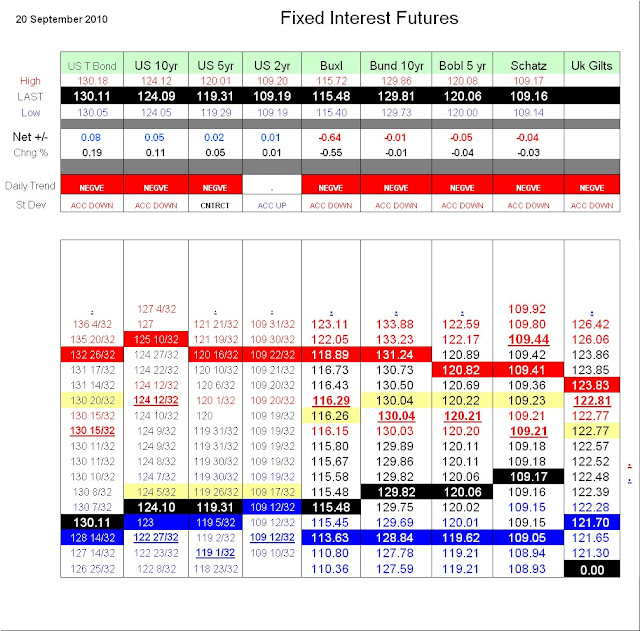

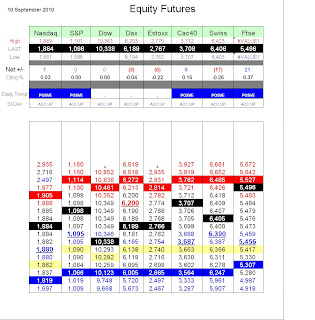

Global Macro Futures- Standard Deviation Price Tables

All please find attached Price Tables for today's session

For an explanation of how these numbers are derived see Introdiction to Std Deviation price Tables, Post 9 Sept.

Key

Black - Last Price at posting

Yellow - Daily Pivot. Price above "Bullish" and indicative of recent rising prices. Price below "Bearish" and indicative of recent falling prices

Blue - Prices Oversold and should experience some Reversion to Mean

Red - Prices Overbought and should experience some Reversion to Mean

Daily Trend: Posve/Negve/Neutral

Std Dev - measure of internal Daily Trend/Momentum strength (Accelerating Up/Down/Contracting

Enjoy

For an explanation of how these numbers are derived see Introdiction to Std Deviation price Tables, Post 9 Sept.

Key

Black - Last Price at posting

Yellow - Daily Pivot. Price above "Bullish" and indicative of recent rising prices. Price below "Bearish" and indicative of recent falling prices

Blue - Prices Oversold and should experience some Reversion to Mean

Red - Prices Overbought and should experience some Reversion to Mean

Daily Trend: Posve/Negve/Neutral

Std Dev - measure of internal Daily Trend/Momentum strength (Accelerating Up/Down/Contracting

Enjoy

Sunday, 19 September 2010

Multi Yield Curve Analysis-

Every week, I post an updated snapshot of the USA, Eur, GBp and JPY Governement Bond Yield Curves (see below) and a statistical look at the changes, not only of the shape of the Curve but also various Segmaents of each Curve

I assign no "fundamental economic" justification or explanation of why these changes have occured, only that they have and here's buy how much.

Later this week, I will post a series of Charts on someof these segments with one of my Trading models ovelayed showing various stages of "Entry" and "Exit" signals generated for "Flattening" and "Steepening" positions on these Curves

I assign no "fundamental economic" justification or explanation of why these changes have occured, only that they have and here's buy how much.

Later this week, I will post a series of Charts on someof these segments with one of my Trading models ovelayed showing various stages of "Entry" and "Exit" signals generated for "Flattening" and "Steepening" positions on these Curves

|

| [Click to Enlarge] |

Enjoy.

Tuesday, 14 September 2010

Global Macro Futures- Standard Deviation Price Tables

All

Please find atttached today's Table

For an explanation of how these numbers are derived please refer to Post 9th September

Black - Last Price at posting

Yellow- Pivot Daily Moving Average. Close above shows internal Strength. Close below shows internal weakness

Red - Prices overbought and should experience some Reversion to Mean

Blue - Prices Oversold and should experience som Reversion to Mean

Please find atttached today's Table

For an explanation of how these numbers are derived please refer to Post 9th September

Black - Last Price at posting

Yellow- Pivot Daily Moving Average. Close above shows internal Strength. Close below shows internal weakness

Red - Prices overbought and should experience some Reversion to Mean

Blue - Prices Oversold and should experience som Reversion to Mean

Monday, 13 September 2010

Eur & Usa Yield Curve Segment Analysis-Part 2

In my previous Blog, I posted a tabular Table of the USA, EUR, JPY and UK Government Bond Yield Curves and a snapshot of how the various curves has changed over time.

As mentioned before, I look at these values Systematically, in absolute terms, without the need to justify any Economic fundamental argument as to why these changes have occurred or are occurring.

Fig 1 below is a derivative of this Table with one of my "Momentum trending models" overlaid on the EUR and USA curves.

The analysis is split between 2 timescales

Also included is a Standard deviation calculation of each of these spreads which could be viewed as values where each of the Curves may encounter a reversion to Mean ( Support and Resistance in bps)

One thing of note recently is the obvious change in the front end of the EUR Curve which has recently changed from "Steepening" (2yr outperforms 5yr) to "Flattening" ie: weakness in the front end ie: (2yr underperforms 5 yr)

The USA eqivalent, however,still maintains a "Steepening" stance but the momentum of this is beginning to weaken but has not yet confirmed a similar move to "Flattening"

In absolute terms in the past month EUR 2's 5's has flattened 17 bps while the USA equivalent has steepened 6 bps

I will Post periodically on any significant change in trend of these Curve Segments

Enjoy

As mentioned before, I look at these values Systematically, in absolute terms, without the need to justify any Economic fundamental argument as to why these changes have occurred or are occurring.

Fig 1 below is a derivative of this Table with one of my "Momentum trending models" overlaid on the EUR and USA curves.

The analysis is split between 2 timescales

- Longer term trend -(Weekly )

- Intermediate trend- (Daily).

Also included is a Standard deviation calculation of each of these spreads which could be viewed as values where each of the Curves may encounter a reversion to Mean ( Support and Resistance in bps)

One thing of note recently is the obvious change in the front end of the EUR Curve which has recently changed from "Steepening" (2yr outperforms 5yr) to "Flattening" ie: weakness in the front end ie: (2yr underperforms 5 yr)

The USA eqivalent, however,still maintains a "Steepening" stance but the momentum of this is beginning to weaken but has not yet confirmed a similar move to "Flattening"

In absolute terms in the past month EUR 2's 5's has flattened 17 bps while the USA equivalent has steepened 6 bps

I will Post periodically on any significant change in trend of these Curve Segments

Enjoy

Friday, 10 September 2010

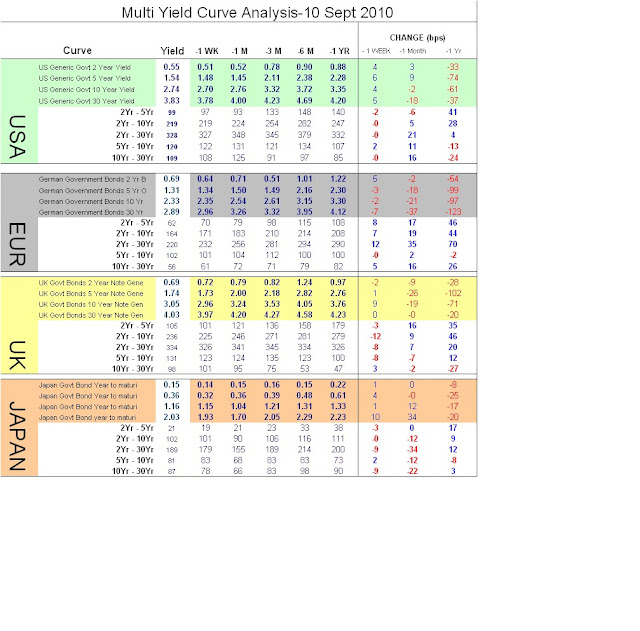

Multi Yield Curve Analysis update- Eur, Usa, UK and Jpy

What a difference a Week makes!

In previous posts, I outlined an old habit of periodically taking a look at how the various Government Bond Yield Curves had changed over time.

Quick to stress though that I view the changes now Systematicaly, purely as a statement of Price/Yield movements, avoiding any interpretation of "fundamental economic" mumbo jumbo that others in their wisdom may apply by way of explanation or justification.

Fig 1: shows German Govt 10 yr yields rising +33 bps from last weeks low of nearly 2% and the Bund future falling from 133.38 to 130.28, I thought it a good time to Post the latest breakdown of which segments of each Curve had changed and by how much

Fig2 below also shows one of our Trading models and historic trading Signals on the 2yr versus 10 yr part of the Eur Curve showing the "Flattening" ( -2's +10's ) duration weighted signal on the 24 May at -218 bps , currently -163 bps.

Interpret as you will

Enjoy

In previous posts, I outlined an old habit of periodically taking a look at how the various Government Bond Yield Curves had changed over time.

Quick to stress though that I view the changes now Systematicaly, purely as a statement of Price/Yield movements, avoiding any interpretation of "fundamental economic" mumbo jumbo that others in their wisdom may apply by way of explanation or justification.

Fig 1: shows German Govt 10 yr yields rising +33 bps from last weeks low of nearly 2% and the Bund future falling from 133.38 to 130.28, I thought it a good time to Post the latest breakdown of which segments of each Curve had changed and by how much

Fig2 below also shows one of our Trading models and historic trading Signals on the 2yr versus 10 yr part of the Eur Curve showing the "Flattening" ( -2's +10's ) duration weighted signal on the 24 May at -218 bps , currently -163 bps.

Interpret as you will

Enjoy

|

| [Click to enlarge] |

Standard Deviation Price Tables- Global Macro Futures

Find below latest Standard deviation price tables for todays trading session.

For an explanation of how these numbers have been derived see Previous post: Tues 7 September

Red: Prices Overbought . Should experience some Reversion to Mean

Black- Last Price

Yellow - Daily Pivot Moving Average. Close above positive. Close below negative

Blue - Prices Oversold. Could expect some Reversion to Mean

Daily Trend- Positive/Negative/Neutral

St Dev- Rate of Change of Trend ( Accelerating Up/Down or Neutral)

For an explanation of how these numbers have been derived see Previous post: Tues 7 September

Red: Prices Overbought . Should experience some Reversion to Mean

Black- Last Price

Yellow - Daily Pivot Moving Average. Close above positive. Close below negative

Blue - Prices Oversold. Could expect some Reversion to Mean

Daily Trend- Positive/Negative/Neutral

St Dev- Rate of Change of Trend ( Accelerating Up/Down or Neutral)

Thursday, 9 September 2010

Standard Deviation Price Tables- Global Macro

In a previous post I introduced a snapshot of a series of "Support & Resistance" levels for some Exchange traded Futures.

On request, I intend to publish a Weekly post of the above, split acoss 3 Asset classses called the "Global Macro Standard Deviation Price Tables". The numbers have been derived from calculating a Standard deviation extensionS up and down from a moving average diversified across 3 different Trading time horizons (Weekly, Daily, and 30 mins).

In a future post, I will explain in greater detail this calculation and discuss the difference between two commonly used technical trading tools "Bollinger bands" and "Keltner Bands".

Please note that this is a snapshot. Prices are dynamic and in the real trading environment these values may change over time.

Also included, is my view of the current Daily trend (Posve, Negve or Neutral) and a brief comment on the rate of change of that trend ( Accelerating Up/Down or Contracting)

[Click to enlarge tables]

Enjoy

Black - Last Price at posting

Yellow - Daily median Pivot

Blue - Price where market is Oversold and may experience some Reversion to Mean

On request, I intend to publish a Weekly post of the above, split acoss 3 Asset classses called the "Global Macro Standard Deviation Price Tables". The numbers have been derived from calculating a Standard deviation extensionS up and down from a moving average diversified across 3 different Trading time horizons (Weekly, Daily, and 30 mins).

In a future post, I will explain in greater detail this calculation and discuss the difference between two commonly used technical trading tools "Bollinger bands" and "Keltner Bands".

Please note that this is a snapshot. Prices are dynamic and in the real trading environment these values may change over time.

Also included, is my view of the current Daily trend (Posve, Negve or Neutral) and a brief comment on the rate of change of that trend ( Accelerating Up/Down or Contracting)

[Click to enlarge tables]

Enjoy

Black - Last Price at posting

Yellow - Daily median Pivot

- Close above signals recent positive price action

- Close below signals recent negative price action

Blue - Price where market is Oversold and may experience some Reversion to Mean

Tuesday, 7 September 2010

Equity and Fixed Interest Futures- Standard Deviation Price Tables

In the world of asset management there are many "tools" that managers cling to, to either make or support their investment decisions. Some will rely on "Fundamental" Company Balance Sheet and "Earnings" (EPS) analysis, some will draw on the voodoo world of Charting and Technical analysis . The fact that people do so doesn't mean that it is right............ unless you can prove it works!

True, the number of Fund Managers who consider "Technical Analysis" a key part of their decision making armoury has grown substantially in the past 20 years, but again "Does it work?"

Over the years it always amazed me that Traders would look at a Daily bar Chart without really knowing whether that timescale was the optimm one for their application of Risk and the timeframe for that Risk......Or why use a 50 day moving average rather than a 33?

Trading strategies can vary from one asset class to another and for different instruments within an asset class. There is no one single trading strategy that can be employed profitably for all assets and instrumentS. Specific price action tendancies dictate what type of trading strategies are appropriate for a particular asset class or instrument.

For further information on our specific validated Trading methodologies send e-mail to : research@gccquantsignals.com

So then, without giving direct "Buy" or "Sell" recommendations please find a Summary of statistically generated prices that may or may not represent "Support" and "Resistance" levels for a series of derivative instruments. The numbers are derived from a simple Standard deviation calculation from a particular moving average set across 3 different Trading time horizons (Weekly, Daily and 30 minutes).

Fig 1. above shows the front month futures contract across a series of Equity Exchange traded futures and highlights where the current price ( in Black) is relative to the standard deviation price calculations mentioned earlier

Prices movements are dynamic and are constantly changing but this "snapshot" may provide an insight to relative strength.

Price closes above the YELLOW median highlighted number can be contrued as being "positive" and trending upwards.

The RED highlighted areas are where statistically the Price is overbought and should experience some Reversion to Mean

The BLUE highlighted area are where statistically the Price is Oversold and should experience some reversion to Mean

Fig 2 below shows a similar representation across a series of Fixed Interest futures as of todays trading date

True, the number of Fund Managers who consider "Technical Analysis" a key part of their decision making armoury has grown substantially in the past 20 years, but again "Does it work?"

Over the years it always amazed me that Traders would look at a Daily bar Chart without really knowing whether that timescale was the optimm one for their application of Risk and the timeframe for that Risk......Or why use a 50 day moving average rather than a 33?

Trading strategies can vary from one asset class to another and for different instruments within an asset class. There is no one single trading strategy that can be employed profitably for all assets and instrumentS. Specific price action tendancies dictate what type of trading strategies are appropriate for a particular asset class or instrument.

For further information on our specific validated Trading methodologies send e-mail to : research@gccquantsignals.com

So then, without giving direct "Buy" or "Sell" recommendations please find a Summary of statistically generated prices that may or may not represent "Support" and "Resistance" levels for a series of derivative instruments. The numbers are derived from a simple Standard deviation calculation from a particular moving average set across 3 different Trading time horizons (Weekly, Daily and 30 minutes).

|

| [Click to enlarge] |

Fig 1. above shows the front month futures contract across a series of Equity Exchange traded futures and highlights where the current price ( in Black) is relative to the standard deviation price calculations mentioned earlier

Prices movements are dynamic and are constantly changing but this "snapshot" may provide an insight to relative strength.

Price closes above the YELLOW median highlighted number can be contrued as being "positive" and trending upwards.

The RED highlighted areas are where statistically the Price is overbought and should experience some Reversion to Mean

The BLUE highlighted area are where statistically the Price is Oversold and should experience some reversion to Mean

Fig 2 below shows a similar representation across a series of Fixed Interest futures as of todays trading date

|

| [Click to enlarge] If you would like further information on the content of this Blog Please send e-mail to :research@gccquantsignals.com Enjoy |

Thursday, 2 September 2010

The "Keith Moon" Yield Curve Analysis-Sept 2010

Oh the past , the past , the past!!!

As a former Market Maker/Primary Dealer in UK Gilts (1987-1993), it took me a long time in the UAE to adjust to startimg my Trading day and my daily routine without a yield curve. I felt somehow naked, unprepared and missing the "fountain of knowledge" that could be gleaned from a Curve.

Like many other things, I do it only periodically these days, now, thankfully, without attributing any naieve "fundamental economic" interpretation for the justification of changes in any particular Curve.

A distant memory now are the days of the UK Chancellor/HM Treasury/ GBrown selling off the Gold reserves at the bottom of the market because the Curve told him inflation was "dead ". Imagine the mark to market opportunity cost of that one, > £4 Bn methinks and yet he still became UK Prime Minister!!

A distant memory are the days of 5yr UK Gilts with coupons like 14% 1996, "Winnies" 13 1/2%1992 or "E aw's" 13 1/2% 1994. They are long gone* (apologies to all you non-Gilt people), or the Un-dated "War Loan" famous for being the only UK Gilt where the Price and GRY yield crossed eachother! That couldn't happen in an efficient market, surely?

The thought of 10yr Bunds possibly ever ever yielding less than 2% would have certainly brought the men in white coats running...... even from the Bundesbank.

I choose instead, nowadays, to pay a mindful and yet respectful eye at each "Yield Curve" but view them with a colder "Systematic" eye rather than rushing to attribute any fragmented Macro economic view of what is or has been happening in the worThey say an Economist will "always be right", eventually. Now I say "Show me the evidence!"

Forget Roger Bootle, Jim O'Neill et al. One might as well exhalt the prophetic lyrics of the 1980 classic Vapors song "Turning Japanese" but somehow, I dont think they were talking about interest rates or were they?...........

Or what about Jean Jacques Burnel, bass guitarist from the fantastically talented "The Stranglers"? His 1979 debut solo album was insightfully entitled "Euroman Cometh". Curious too, that Track 4 was prophetically entitled "EuroMess"! Strange that he was French not Geek then. Must be the No1 favourite disc in Pierre Bergovoy's collection.

So, eat your heart out Nostradamus ! ...................or was that Nosferatu? ..........................er sorry No, that was in fact Hugh Cornwell's debut solo album, lead guitarist of ???????? Yes.........you guessed it "The Stranglers"! Apologies I digress but, anyway, you get my point.

As the market de-leverages from the Credit Crisis, the free money "carry trades" that were so in vogue in the 80's and 90's in the high interest rate environment are almost a relative thing of the past. People have seemingly forgotten the Yield Curves.......... after all, they ARE boring now aren't they?

Perhaps a new generation of first time property buyers in this low interest rate environment who, when they find their mortgage payments doubling and try to lock in a competitive fixed rate (which wont be there), may prove the justification for another further negative property bubble ?

Better sages than I will explain (no doubt after the fact !).

So then, for an accurate answer, why not quiz Jet Black, the Strangler's drummer or perhaps even Robert Prechter of Elliot Wave fame, who by co-incidence, is also a drummer? Scary isnt it?

Every month, therefore, I too intend to put down my drumsticks and publish a qick snapshot of the USA, EUR and UK government bond Yield Curves, in future to be known as the "Keith Moon" Yield Curves and illicit a short analysis of how each segment has changed over time eg: 2yr-5yr; 2yr-10yr, 2yr-30yr etc. I will not be so foolhardy and rash to explain "Why" they have moved, only that they have, and by how much.

Whooooooo are you? Who who, Who who? I really wanna know.

Thanks Keith

Interpret as you will and hopefully enjoy!

As a former Market Maker/Primary Dealer in UK Gilts (1987-1993), it took me a long time in the UAE to adjust to startimg my Trading day and my daily routine without a yield curve. I felt somehow naked, unprepared and missing the "fountain of knowledge" that could be gleaned from a Curve.

Like many other things, I do it only periodically these days, now, thankfully, without attributing any naieve "fundamental economic" interpretation for the justification of changes in any particular Curve.

A distant memory now are the days of the UK Chancellor/HM Treasury/ GBrown selling off the Gold reserves at the bottom of the market because the Curve told him inflation was "dead ". Imagine the mark to market opportunity cost of that one, > £4 Bn methinks and yet he still became UK Prime Minister!!

A distant memory are the days of 5yr UK Gilts with coupons like 14% 1996, "Winnies" 13 1/2%1992 or "E aw's" 13 1/2% 1994. They are long gone* (apologies to all you non-Gilt people), or the Un-dated "War Loan" famous for being the only UK Gilt where the Price and GRY yield crossed eachother! That couldn't happen in an efficient market, surely?

The thought of 10yr Bunds possibly ever ever yielding less than 2% would have certainly brought the men in white coats running...... even from the Bundesbank.

I choose instead, nowadays, to pay a mindful and yet respectful eye at each "Yield Curve" but view them with a colder "Systematic" eye rather than rushing to attribute any fragmented Macro economic view of what is or has been happening in the worThey say an Economist will "always be right", eventually. Now I say "Show me the evidence!"

Forget Roger Bootle, Jim O'Neill et al. One might as well exhalt the prophetic lyrics of the 1980 classic Vapors song "Turning Japanese" but somehow, I dont think they were talking about interest rates or were they?...........

Or what about Jean Jacques Burnel, bass guitarist from the fantastically talented "The Stranglers"? His 1979 debut solo album was insightfully entitled "Euroman Cometh". Curious too, that Track 4 was prophetically entitled "EuroMess"! Strange that he was French not Geek then. Must be the No1 favourite disc in Pierre Bergovoy's collection.

So, eat your heart out Nostradamus ! ...................or was that Nosferatu? ..........................er sorry No, that was in fact Hugh Cornwell's debut solo album, lead guitarist of ???????? Yes.........you guessed it "The Stranglers"! Apologies I digress but, anyway, you get my point.

As the market de-leverages from the Credit Crisis, the free money "carry trades" that were so in vogue in the 80's and 90's in the high interest rate environment are almost a relative thing of the past. People have seemingly forgotten the Yield Curves.......... after all, they ARE boring now aren't they?

Perhaps a new generation of first time property buyers in this low interest rate environment who, when they find their mortgage payments doubling and try to lock in a competitive fixed rate (which wont be there), may prove the justification for another further negative property bubble ?

Better sages than I will explain (no doubt after the fact !).

So then, for an accurate answer, why not quiz Jet Black, the Strangler's drummer or perhaps even Robert Prechter of Elliot Wave fame, who by co-incidence, is also a drummer? Scary isnt it?

Every month, therefore, I too intend to put down my drumsticks and publish a qick snapshot of the USA, EUR and UK government bond Yield Curves, in future to be known as the "Keith Moon" Yield Curves and illicit a short analysis of how each segment has changed over time eg: 2yr-5yr; 2yr-10yr, 2yr-30yr etc. I will not be so foolhardy and rash to explain "Why" they have moved, only that they have, and by how much.

Whooooooo are you? Who who, Who who? I really wanna know.

Thanks Keith

Interpret as you will and hopefully enjoy!

|

| [Click to enlarge] |

Saturday, 28 August 2010

Eur & Usa Yield Curve Segment Analysis- (2's 10's) Weekly Chart

Every week, we intend to publish commentary on various Government Bond Yield Curves, both as individual curves, and also analyse the movement of spreads between them.

In these examples,we will overlay one of our Trend following models on a particular segment of each of the curves and highlight the most recent trading entry & exit signals.

Today, we explore 2 yr versus 10 yr on both the Eur and USA curves (Weekly) going back to 2004 and also take a look at the 10 yr spread between both curves. The Chart is colour coded for illustration as follows:

Blue:=Flattening Black:=Neutral Red=Steepening* (2's outperform 10's)

Chart 1 [Click to enlarge]

In August, most Fixed Interest continued to push higher (in price terms, lower yields) while Equity markets weakened but it is interesting to note an acceleration in the change in the front segment of Curves

eg: Eur 2's 10's flattening from -220 bps on 31 May to current -157 bps.

We are not interested in any fundamental justification and timing for such a move, only a cold statistical analysis of the price behaviour

Curve Segment: Eur 2yr v's Eur 10 yr

Trend : Flattening (2's underperform)

Entry signal 24/5/10 -218 bps

Current: -157 bps

Resistance: -151 bps

Support : -168 bp

Exit Signal: none

Subscribe to:

Comments (Atom)